When it comes to managing your Money

Don't Do It Yourself

All fydaa portfolios are made of Exchange Traded Funds(ETFs), rather than few stocks or bonds, to create stable growth for your Investments.

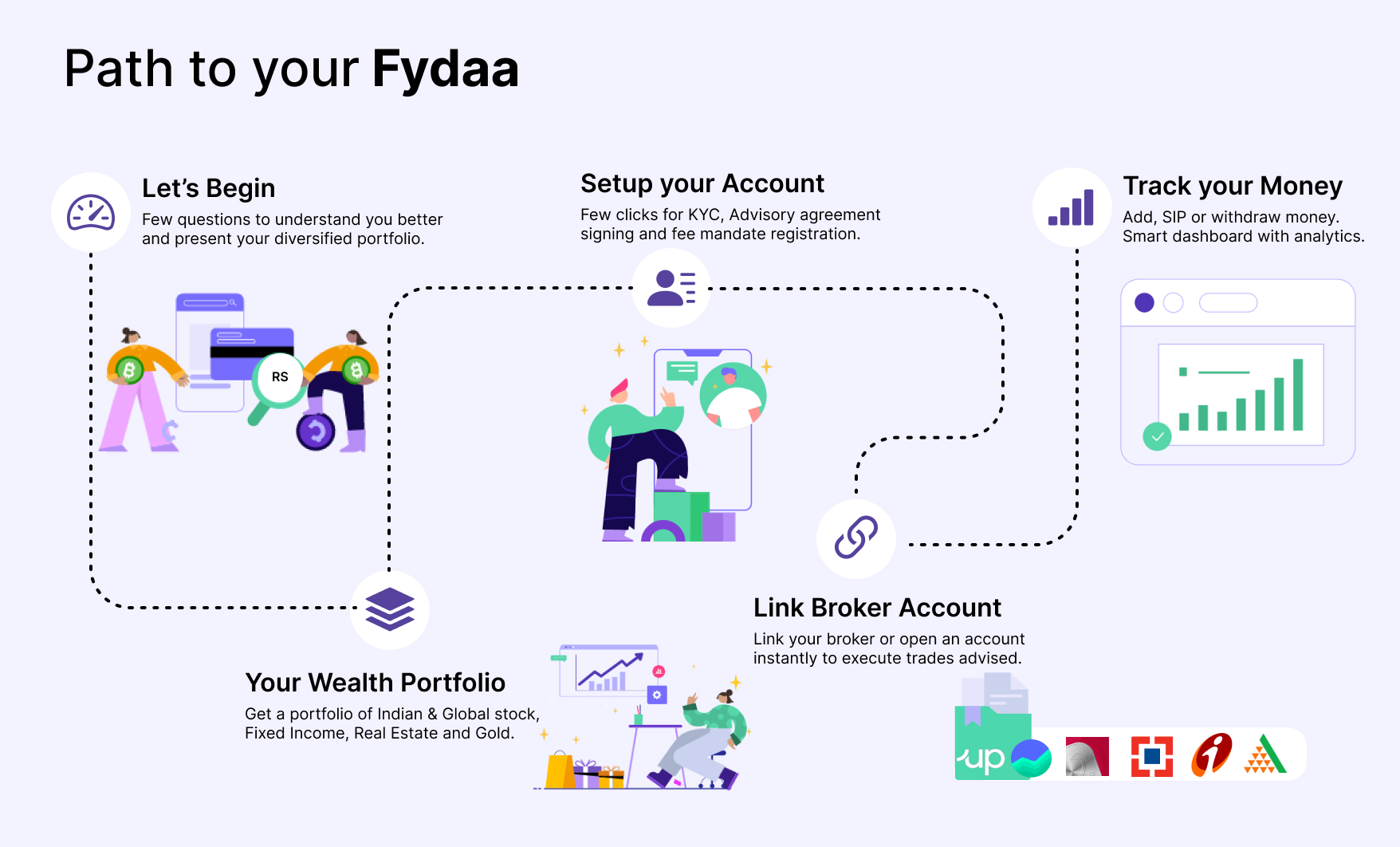

Empowering every Indian to take control of their financial future.

Get a super-simple, multi-asset, globally diversified portfolio of ultra low-cost exchange traded funds (ETFs).

All fydaa portfolios are made of Exchange Traded Funds(ETFs), rather than few stocks or bonds, to create stable growth for your Investments.

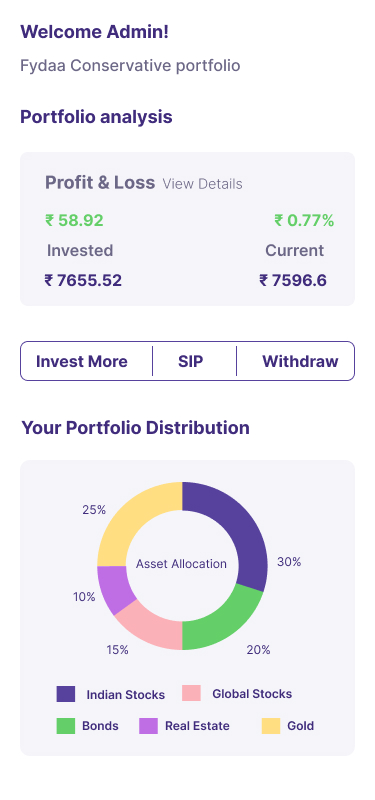

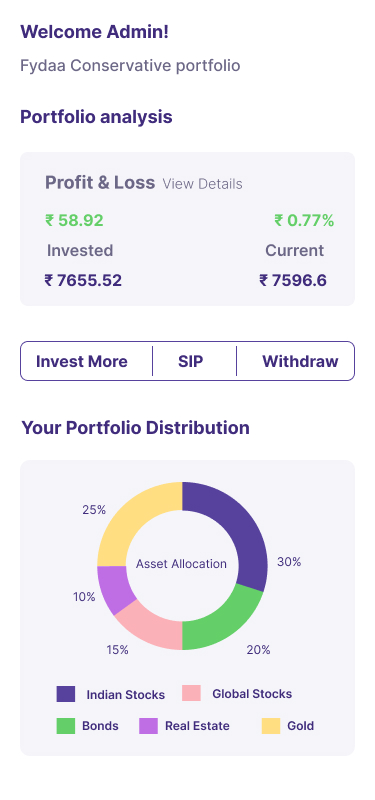

Every fydaa Investor owns assets across following assets - Indian and Global Stocks, Fixed Income, Real Estate and Gold.

All in one single brokerage account of your choice.

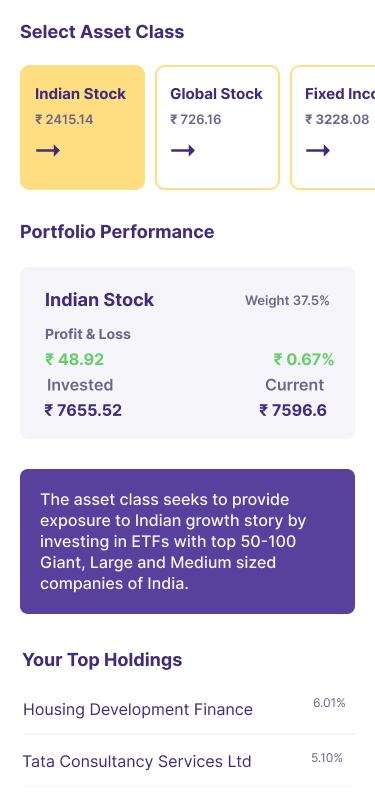

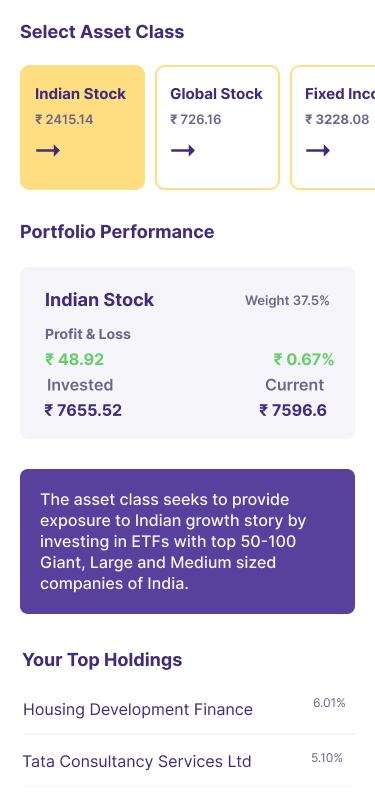

Every fydaa Investor owns top 100 companies in India - Giant, Large and Medium sized companies with just one click. No need to put your mind in which stocks to buy, how much and when.

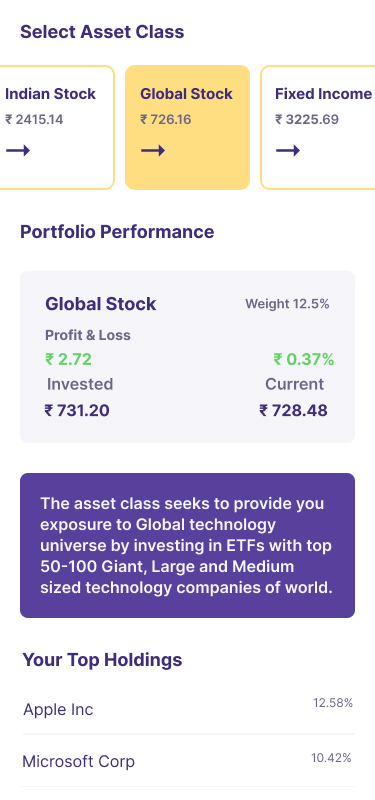

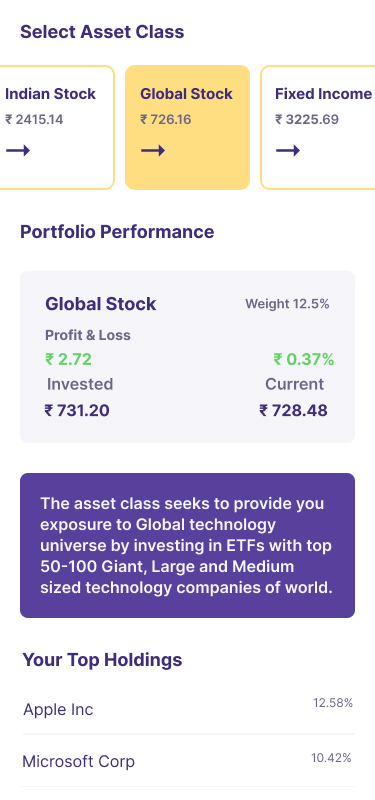

Every fydaa Investor owns top 100 Global companies - No need to open any separate foreign brokerage account.

All with one click in your existing Indian brokerage account of your choice.

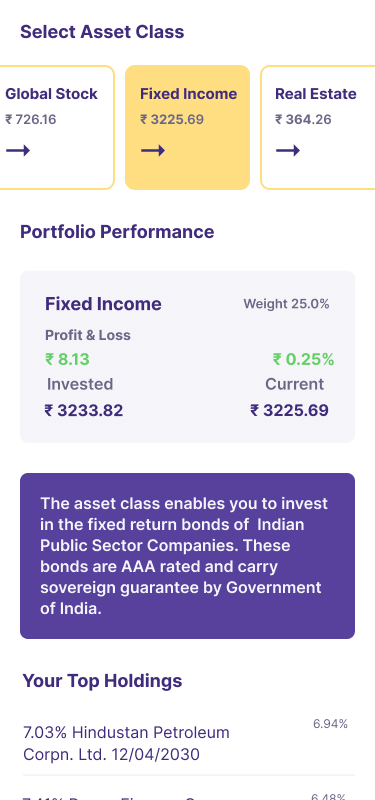

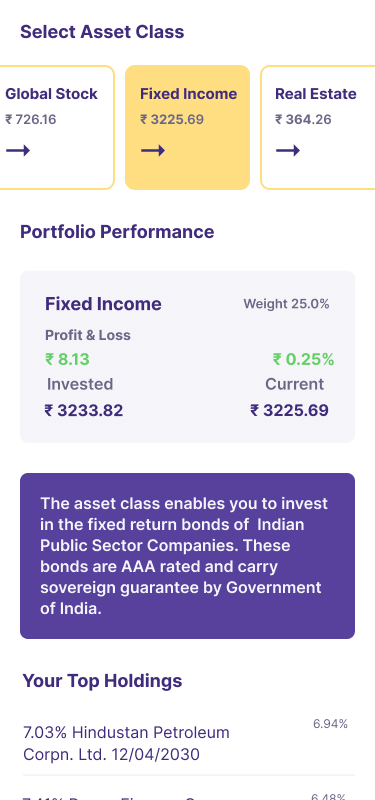

An investment option enabling you to invest in the bonds of Public Sector Companies through one investment (Guaranteed by Government of India), again one click in your existing Indian brokerage account of your choice.

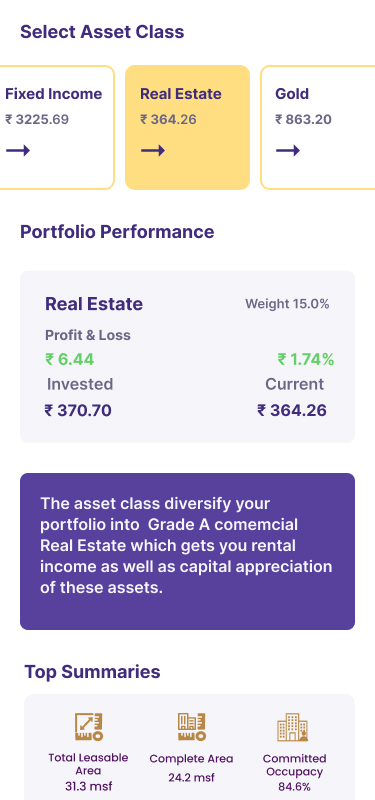

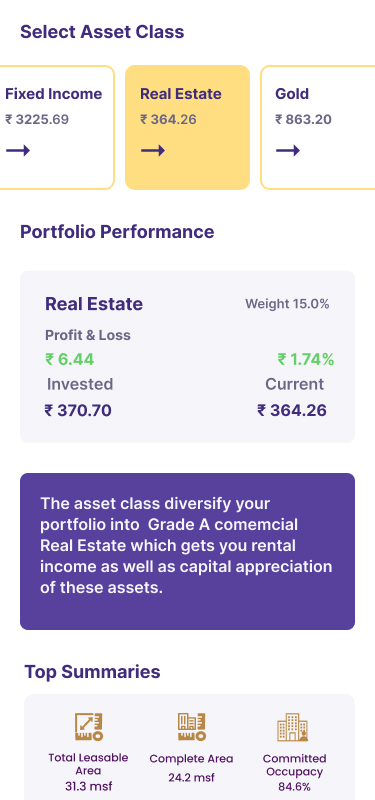

Every fydaa Investor owns top A grade commercial properties - Receive rentals from top tenants directly in your bank account as well as participate in long term capital appreciation, again with one click in your brokerage account.

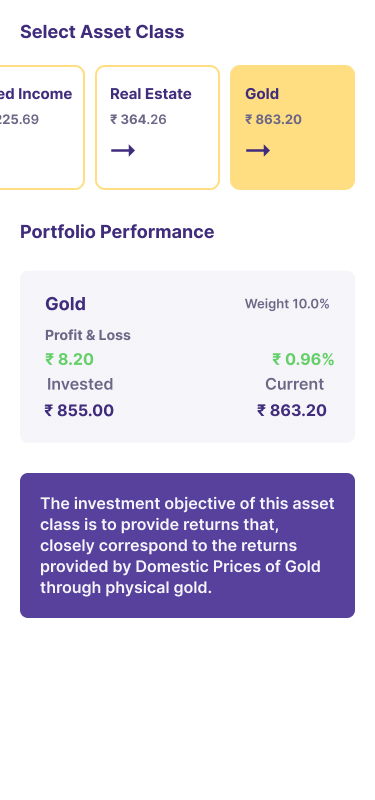

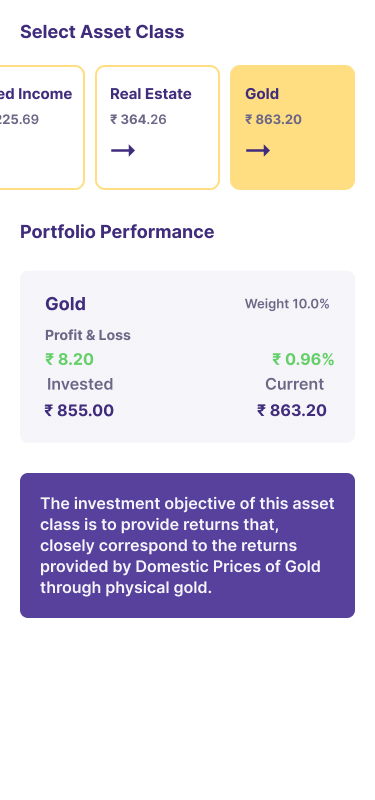

Every fydaa Investor owns Digital Gold - No need to physically own to participate in gains on capital appreciation, again with one click in your brokerage account.

Use the slider to see how passive investing (ETFs) and right asset allocation can grow your money.

Bank Fixed Deposit Account *

Multi-Asset Investment account after 30yrs*

*For illustration purpose only and not recommendatory. "Past performance is not a guarantee of future performance.” Know More

If you invest

The heart of leadership is kindness—with a little bit of mind-ness on the side

Founder & Product Lead

Over 20+ years experience in Investment Management and Investment Banking.

Technology Lead

Over 7+ years of building technology experience for startups

Growth Lead

A passionate individual/entrepreneur with a knack for building startups from the ground up.

Leave your details we will get back to you soon